February 4th, 2026

Improved

What’s new

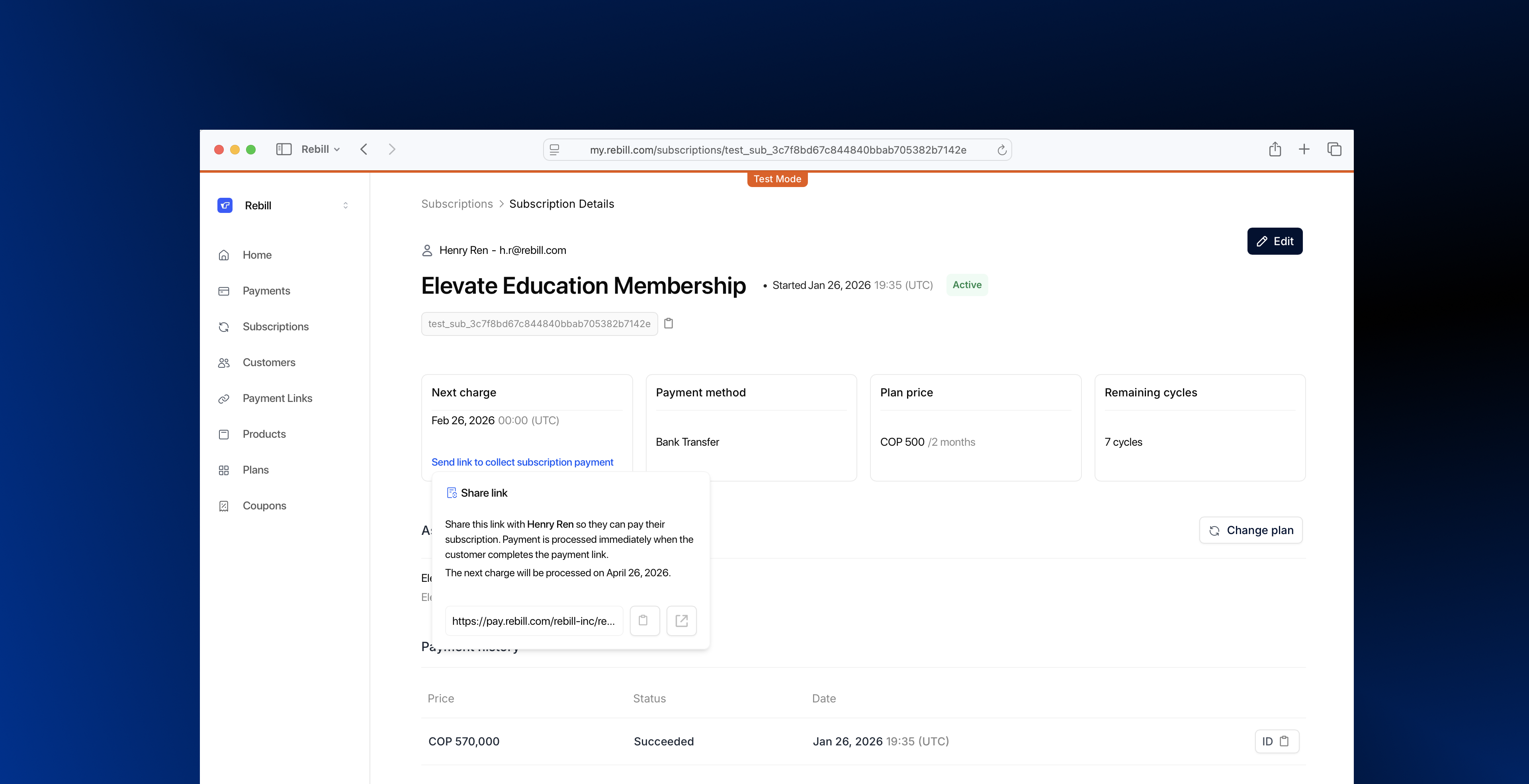

You can now generate a renewal payment link directly from a subscription.

Share it with your customer so they can get up to date with their payments—without changing the subscription or waiting for the next automatic charge.

Why it matters

Recovering a subscription isn’t always about failed payments.

Sometimes the customer:

Didn’t receive the renewal email

Opened it too late

Is negotiating timing with your team

Uses an APM and needs extra days to generate the payment coupon

Now you have a simple, flexible way to keep the subscription active and move forward.

How it works

Open the subscription details

Generate the renewal payment link

Share it with your customer

Payment is processed immediately once completed

The next charge follows the original subscription schedule

Result

More flexibility, faster recovery, and less dependency on support.

February 3rd, 2026

What’s new

We improved the plan preview in Payment Links.

Now, when you select a predefined plan, you can clearly see how often the customer will be charged and how long the plan lasts—directly in the setup and preview views.

This includes:

Billing frequency (e.g. every month)

Duration (e.g. ends after 6 charges or ongoing)

Why it matters

Before, plan previews only showed the name and price. That made it easy to miss critical details like recurrence type or total charges—leading to configuration mistakes, follow-ups, or manual fixes.

Now, everything is visible upfront.

What you configure is exactly what the customer will see and be charged.

Result

Fewer mistakes when creating payment links

More confidence before sharing a link

How it works

This improvement is live automatically in the Payment Link builder and plan preview. No action required.

February 2nd, 2026

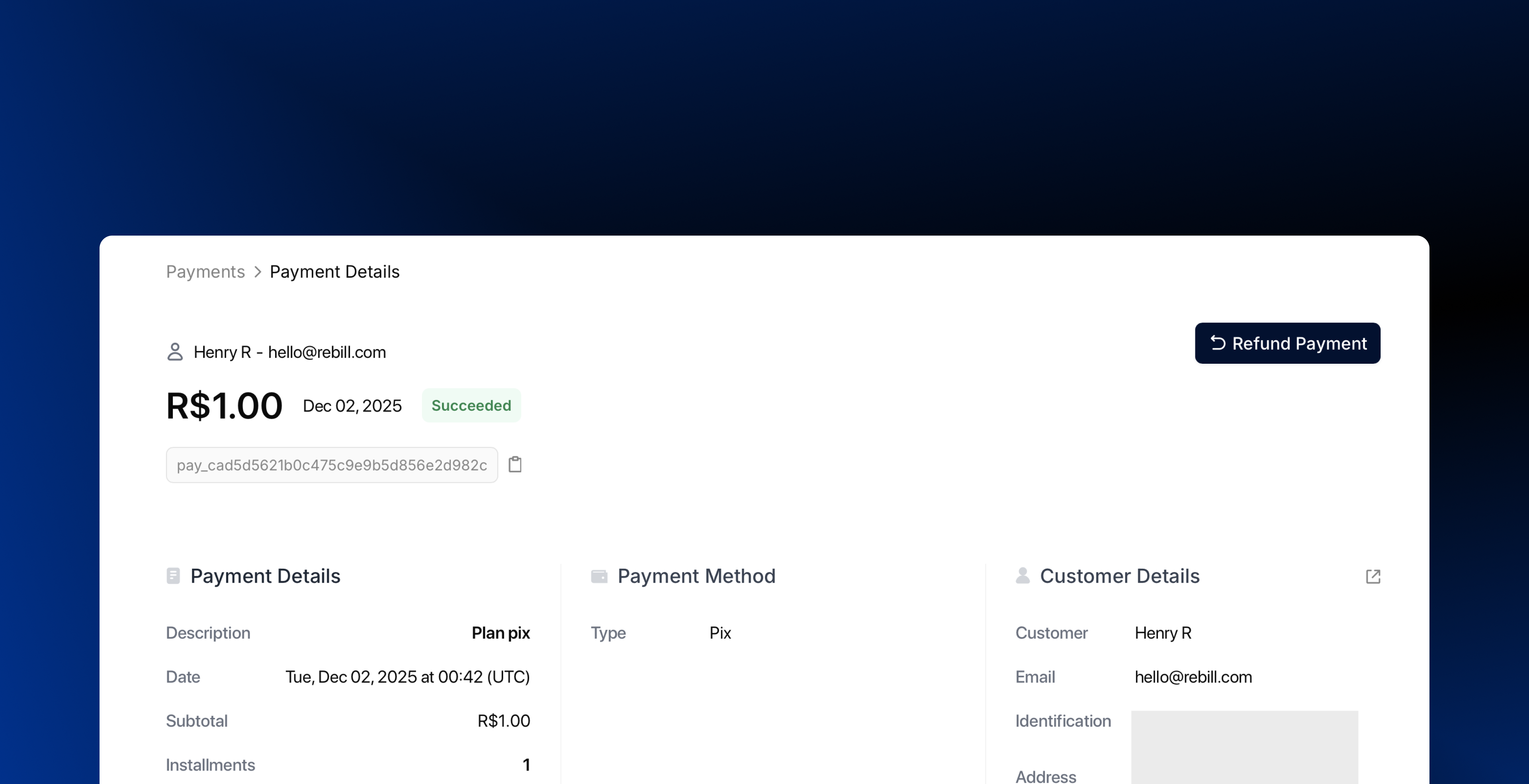

We’ve improved refunds across LATAM by extending refund time limits in key markets and enabling direct PIX refunds from the Dashboard.

What’s improved

Longer refund windows for card payments in key countries, giving teams more time to handle post-payment issues.

PIX refunds are now fully self-serve from the Dashboard, with no support tickets or manual workflows.

Updated limits

Mexico – Cards: up to 120 days

Brazil – Cards: up to 180 days

Colombia – Cards: up to 180 days

Brazil – PIX: 90 days

Why it matters

More autonomy. Less dependency on support.

Teams can resolve refund requests directly from the Dashboard, even days after the original payment—without waiting on manual processes or workarounds.

👉 Learn more: Refund time limits documentation

January 29th, 2026

Subscriptions change as your business changes.

And now, managing those changes is built in.

You can now edit active subscriptions directly from the Dashboard, without canceling them or creating new ones.

What’s new

Merchants can update subscription rules at any time, including:

Change the billing frequency

Move from monthly to every 2 months (or any configured interval).Switch from infinite to fixed billing

Define exactly how many charges a subscription should run.Adjust remaining charges

Update how many payments are left — ideal for special deals, retention offers, or advance payments.

All changes apply seamlessly, keeping the subscription active and aligned with the new terms.

Why it matters

Subscriptions aren’t one-size-fits-all.

Until now, adjusting an active subscription often meant:

Canceling and recreating it

Managing exceptions manually

Tracking custom agreements outside the system

Now, subscriptions adapt to your business — directly from the Dashboard.

More flexibility.

Less operational overhead.

Full control over every subscription.

January 28th, 2026

What’s new

You can now pre-fill customer information when creating a Payment Link.

From the Dashboard, merchants can define customer details in advance so the checkout opens with key fields already completed.

You can pre-fill:

Email

Full name

Phone number

Billing details (address, city, zip code, country)

Language

All fields remain editable by the customer at checkout.

Why it matters

Every extra field adds friction.

By pre-filling customer information:

Customers complete payments faster

Fewer errors during checkout

Less drop-off in assisted or personalized sales

This is especially useful for invoices, one-off payments, and any flow where you already know your customer.

Result: faster checkouts, smoother payments, higher conversion.

January 27th, 2026

New

What’s new

You can now define default installment rules per currency that are automatically applied when creating new payment links.

This means merchants no longer need to reconfigure installment options every time they create a link.

From Settings → Installment financing, you can:

Define which installment options are available per currency

Set default installment rules for all newly created payment links

Override installments per link when a custom setup is needed

Why it matters

Installments are a core part of pricing in LATAM—and merchants often reuse the same rules across sales.

Until now, they had to reconfigure installment options every time they created a new payment link.

With default installment rules:

Merchants avoid repeating the same setup

Teams create links faster

Installment options stay consistent across sales

More control, without slowing down the workflow.

January 26th, 2026

New

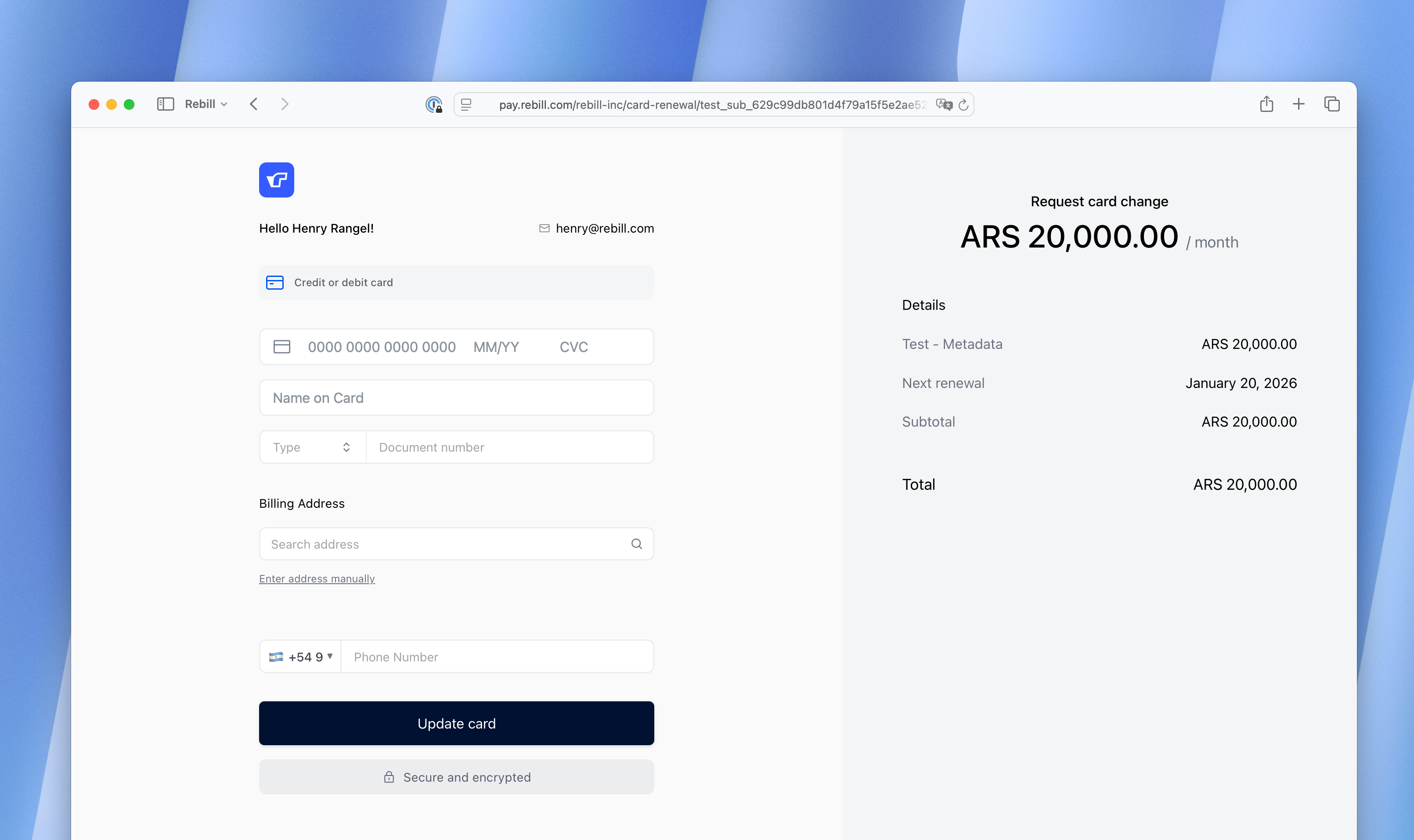

You can now generate a renewal link from the Subscription Details view to collect overdue payments and recover subscriptions — even when the original payment method no longer works.

What’s new

Generate a secure renewal link for any subscription

Let customers complete the payment instantly

Support cards and local payment methods

Allow customers to switch from bank transfer or cash (APMs) to card when needed

All without canceling or recreating the subscription.

Why it matters

In LATAM, subscriptions often fail due to payment friction:

Bank transfers not completed on time

Retries exhausted

Delayed confirmations from local methods

Instead of losing the subscription, merchants can step in with one simple action.

The renewal link gives teams a manual recovery lever — without breaking history, changing plans, or touching code.

One subscription. More ways to recover it.

January 23rd, 2026

New

What’s new

You can now limit the number of installments shown to customers when paying through a Payment Link.

From the Dashboard, merchants can define which installment options are available per currency, all within a single payment link.

This works for:

Product links

Instant links

Why it matters

In LATAM, installments are a core part of the buying decision.

Until now, merchants often had to:

Rely on customers to select the agreed number of installments

Manually verify payments afterward

Handle exceptions and operational overhead

Merchants define the conditions.

Customers only see valid options.

January 22nd, 2026

New

What’s new

You can now generate and send a secure card update link directly from the Dashboard.

From any subscription, you can:

Generate a secure, time-limited card update link

Share it manually or send it via email, SMS, or WhatsApp

Let customers update their card without friction

Why it matters

Card updates are now a simple, built-in action.

Any team can access this directly from the Dashboard—no extra steps, no detours—using the same channels you already rely on to reach customers.

January 21st, 2026

New

API

We’ve added a new API endpoint that allows you to generate a secure, time-limited link for updating the payment card associated with a subscription.

This is especially useful for recovering failed renewals due to expired or replaced cards, without requiring direct customer support involvement.

What’s included

A new endpoint to generate card update links

Hosted, secure card update page

No immediate charge when updating the card